Theme 2 Module 1

Theme 2: the First Century 1789-1890

WELCOME and Introduction to First Century ED

America as a nation came together in the 1780’s, and the new Republic was founded in 1789. American ED, borrowed (from England), mostly defined itself. Early American decision-makers and economic developers developed strategies, tools, and programs-initiatives by reacting to, and experimenting with confronted realities. They adapted to dynamics that flowed out of the slow emergence of a new economic system (capitalist industrialization), in a new semi-democratic nation, with a new form of government carved out and of a virgin wilderness, battling and suppressing indigenous inhabitants. If there is such a thing as “systemic innovation” the United States was it.

They lacked, however, an important, an essential element, of modern ED–urbanization. Theirs was an agricultural economy, without cities of size, late medieval in function and governance. As mere “mechanisms” of British royal control, municipal and colonial governments were grossly underpowered, and were further constrained by the theories and value system of the emerging industrial capitalism.

Nineteenth century American economic development was led and implemented chiefly by private business/old wealth elites who founded private economic development organizations (EDOs) to serve their ends. That form of ED crystallized into a business-capitalist oriented ED, we call Privatist MED. It was the “mainstream” approach, but it had faults and limitations. Over the course of the 19th Century an alternative, Progressive form of ED developed in reaction to Privatist MED–today called Community Development (CD).

Privatism and MED and Progressivism CD are the Two Ships of American ED.

These two approaches to American ED were impacted by the values, beliefs and priorities of a constant stream of immigrants, religious, economic and/or political refugees. Settling and migrating, these immigrant/nativist streams opened up the interior of the thirteen original colonies and then proceeded inward, to the east banks of the Mississippi River, and outward to the Pacific Coast.

The cities and states they founded as they trekked across the continent reflected their values, beliefs and priorities. An early truth that logically follows from these diverse “political cultures”, geographical (locational) variations, and staggered over time urban development, is there never was a single, one-size-fits-all state and local ED, or policy system that produced them. Each state and city, while sharing common features and patterns with others, fabricated their own specific way to ED. American ED, both CD and MED, is a “bottoms-up”, or decentralized approach to ED.

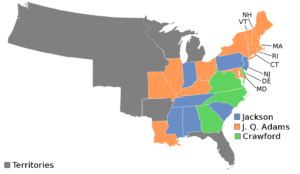

What unity there was among cities, policy systems, and states was found in the nation’s regions. In the 19th century there were initially three regions (North, South, and “Wilderness” which was called the West). The North was home base to the emerging industrial capitalism–and it captured nearly all of the new immigrant streams. The South was an almost medieval manor-based (plantation/slave) agricultural-export economy–and was determined to stay that way. I suspect the reader knows how all that turned out. Suffice it to say here, the Civil War was a page-turning event in our American ED history.

Through a great deal of the 19th century, American ED was economically bi-modal. Settlement of the “Wilderness-West” reflected these competing economic systems–and so did American ED. Given that competition and the variation and time lags of western/wilderness settlement, American ED assumed a “regional” character as state and local policy systems.

To the extent they shared common dynamics, strategies/programs amid their distinctiveness, American ED was very “regional”. Over time, even by the end of the 19th century, the original three regions fragmented–with the Midwest, the Old Confederate South, Texas and the Southwest, the Pacific Coast and western Mississippi Central States. This regional fragmentation continues (Mountain states, for example) adding an important dimension to our “bottoms-up” historical approach.

In 1789, economic developers did not start completely from scratch. They inherited important colonial tools such as tax abatement, bond/debt issuance and eminent domain which they used to power their strategies and programs. Their strategies and programs, however, were cast from newly-manufactured whole cloth, almost instinctive reactions to the dynamics and needs they perceived as “out there”.

The wonder is that out of this experimentalism, trial by fire as it were, an enduring set of strategies/programs and effective tools were forged and in place by the end of the 19th century. Those strategies are still in practice as I write this introduction. But in order to appreciate this continuity, the reader might best put aside preconceptions based on today’s dominant paradigms. Strip George Washington of his wig and colonial garb, see him with a scruff beard, a baseball cap, and a cut-off hoodie, he might remind you of someone you know.

Theme 2: the First Century

In Theme 2, I focus mostly on the path followed in eastern/northern states and their Big Cities. That path, a blend of Privatist MED tinged with an business elite which included Progressive/CD elements, was not the only MED path, but it was the one that would dominate our profession and policy area—literally until 1975 or so. That path evolved from the conditions, goals, cultures of the people who settled in those states and Big Cities that would form the northern/Midwest industrial hegemony–more on that in the modules. In Theme 2 Southern and Western regional ED is limited to three of the twelve initial modules.

MED captures a great deal of our attention–it was the dominant of the Two Ships. Interestingly, in these earliest years (until 1890’s), MED economic developers worked cooperatively alongside the other approach to American ED—community development. They were not so much rivals or enemies—often they were the same person acting in a different capacity—one providing prosperity and growth, the other ameliorating society’s externalities, inefficiencies, injustice and inequalities. Community development will pick up steam in later Themes.

We were not totally industrialists in the beginning, though manufacturing was always the sector MED preferred. MED traced its earliest roots to entrepreneurialism, innovation, sector/industry agglomerations, a physically expanding Big City expressed in CBD and neighborhoods–and a competitive urban hierarchy. MED consistently incorporated concepts and dynamics of an evolving capitalism into its fabric–expanding markets and oligopoly for example. MED, if nothing else, links the community economic base and the community as a whole to our national capitalist industrial economic system. Even if the reader dislikes capitalism, the state and local linkage to the national economic system is a logical and necessary function and a primary MED responsibility.

The linkage with the overall national economic system translates into the reality that states and localities reacted to competition between market areas, the effects of market concentration, and the constant changing of its sector composition because of capitalist Schumpeter-like innovation. That meant MED devised strategies/programs that over time fought different enemies and sought different objectives. Simply put, 19th century attraction is not the same as 21st century attraction. As the reader hopefully plods through this history, she might keep in mind ED’s strategies, programs, purposes, goals and even constituencies change across different time periods–even though the “strategy name” remains the same, the strategy’s use and purposes varies over time and place. A rose is not always a rose.

Economic growth was incredible during the 19th century, even though it was repeatedly punctuated by horrendous recessions/business cycle downturns called “panics”. Panics were powerful catalysts for Community Development and MED, but they also translated into huge inequalities–as well as the hope for incredible opportunities. Industrialization seemingly required risk-taking, innovative owners and investment financiers, and workers or employees–the proletariat. As Facebook stipulates the relationship between the two has been “complicated”.

Capitalism in the wilderness meant the workforce was either refugees from its agricultural hinterland or immigrants. This is a backdoor entrance to socio-economic class. Usually when socio-economic class is brought up, thoughts inevitably drift toward the downtrodden class and how the upper class in its way “lives off of” the downtrodden. And away we go to the barricades and future revolution.

True enough–community development will deal with that scenario more directly. MED, on the other hand, sensitizes the reader that “upper” class is composed of several sub-classes, including community business, managers, professionals owners, and that ever-hated “one percenter”. These fine folk are the main drivers of community level MED–unless and until lower classes inject themselves meaningfully into the community policy processes. We see the first episodes of that conflict in modules to follow.

The modules each tell their own story. We start with MED in 1790, describe the birth of CD, return to MED and finish up with three modules of southern and western regional ED. There is a lot more we can tell,and some topics will be covered in Theme 3 to follow. To the extent the reader wants, the Edgar Elgar website offers chapters (for free) for perusal. These modules supplement, and provide a narrative to my book, As Two Ships, but these modules contain an additional two years of new research.

The sections below detail the principal tools of MED, inherited from colonial years, and incorporated into MED during the 19th century. Tax abatement and eminent domain figure prominently in Theme 2, and if the reader is a community developer, or feels it useful, the sections below outline how, when and why each came to be a mainstay of MED. In this sense they are optional–but are helpful in coming to grips with two of the most controversial tools of American ED–tools which dominate 19th and 20th century ED–and seem, if anything to be gathering strength in the 21st.

If you prefer to go straight to Theme 2 Module 2 Click Here. Otherwise read on below

INHERITED MED TOOLS

Tax abatement and eminent domain have generated more paper, debate, bad feelings, and produced more cost-benefit studies than any other ED tool. Eminent domain is linked to the infrastructure strategy and tax abatement to the business attraction/retention. They both by definition involve private property. Therein lies the core problem—they cross over a “fault line”, a policy no-man’s-land between Privatism and Progressivism. Progressivism is uncomfortable, to put it mildly, with assisting private business, preferring instead to provide tax abatement (think earned income tax credit and progressive income tax rates) to people—poor people. Policy analysts call it redistributive public policy-which, guess what, Privatists are seldom thrilled about.

In life, the core issue is “qui bono” (who benefits): business, society or the disadvantaged. Everybody supports “their” tax abatement or eminent domain—not the other guy’s. During the pre-Civil War years, both ED tools were prominent, used pervasively—actually they were essential– to the ED strategies pursued by states and jurisdictions. They were used by business corporations or hybrid public/private EDOs—either an experiment or a stupidity depending how one views the concept of a “private” EDO. That is a point behind this section: to explain the Early Republic basis for tax abatement and eminent domain for the benefit of private enterprise. The conclusion that follows is “like it or not, it’s legal”. And it’s a part of our ED heritage. Here’s why.

Business Tax Abatement: Economic Development’s Oldest Tool

Tax Abatement is as old as the hills, the Seven Hills of Rome for example. That is the first lesson our history teaches concerning tax breaks. How long have state/municipal-level tax differentials been used in America? The U.S. Supreme Court in the 1871 Wilmington Railroad v. Reid decision traced tax incentives to a North Carolina 1790 exemption incorporated in the Dismal Swamp Canal Company charter. [We did not make this up[i]]. Vermont between 1812 and 1830 exempted local manufacturing firms from state/local taxes (Bruchey, 1968, p. 128)—so did most other states. In a later chapter, even earlier dates will be cited.

One might wonder if some Constitutional clause stops tax abatements dead in their tracks. Obviously not! The power to grant tax abatements stems from the power to tax. If a jurisdiction can tax—the jurisdiction can exempt from taxes. One power is inherent to the other.

The federal Supreme Court decision, Mobile and O.R.R. v. Tennessee (1894) sustained state tax exemption for a particular railroad by recognizing, first, the legislature’s constitutional authority to grant an exemption, and second, ‘that such an exemption might confer either total or partial immunity from taxation, and extend for any length of time the legislature might deem proper.” (Benjamin, 1980, p. 663). It has not yet been overturned.

Oher articles of the Constitution might offer hope. Constitutional clauses requiring federal and state “uniformity” and the equal protection clause are regarded as the next best hopes to limit tax abatement. The “uniformity clause” provides “all Duties, Imposts and Excises shall be uniform throughout the United States“. Most state constitutions mirror this language. Court decisions over the years, however, have created a distinction between direct taxes and “indirect taxes” (duties, fees). The Supreme Court has consistently held that the uniformity clause does not apply to direct taxes[iii]. Property and sales taxes are direct taxes. Benjamin (Benjamin, 1980, p. 663) observes that most state court decisions “apply the federal standard and require only that all tax laws apply generally throughout the state, subject to any exemptions which the legislature may deem necessary“.

For example, a 1978 Supreme Court, decision confirms the power of Congress to “pin-point spending in various localities of intense unemployment and underemployment so that it may choose to concentrate on urban poverty or rural poverty or that it may attack certain sources of poverty without challenging others” and that “Congress must be free to provide tax incentives to businesses located in the poorest neighborhoods so long as those incentives do not violate the uniformity clause by being totally or partially unavailable to any qualified community“[iv]. How specific or narrow can an exemption be? Justice Cardozo’s ruled that abatements may be as “narrow as the mischief“[v].

Next the Equal Protection clause (Fourteenth Amendment) applies only to the states and not to the federal government. That means state/local tax exemptions could potentially be challenged under the equal protection clause. Precedence, however, allows state legislatures broad discretion, bordering on deference, in determining what is taxable or tax exempt. So long as “they and the classification upon which they are based be reasonable, not arbitrary, and apply to all persons similarly situated”. Wheeling Steel, Allied Stores v. Bowers a state may grant exemptions primarily on the basis of residence when public policy factors are also present[vi]. As to whether non-exempted taxpayers (or business competitors) equal rights are violated by tax abatement, Courts have consistently struck down cases that pursued this argument[vii].

Tax Abatement in the Nineteenth Century

If the Supreme Court is correct, the first recorded tax exemption was allowed in Washington’s first year in office. Banks, insurance companies and railroads were the first recipients. Some were intended to launch startups, particularly finance companies and banks; railroads could obtain perpetual abatements. Some abatement was partial; others total. Most states used corporate charters to convey tax abatement. Once granted, it was hard to claw back; tax abatements were interpreted as a contract that could not be breached.

Early Republic statewide tax differentials favoring manufacturing firms were common throughout the nineteenth century. Manufacturers were the gazelles of the day. Post-Civil War economic developers wanted these fast-growing, job-creating firms and they were willing to pay up to get them to locate in their state and city. New York, almost certainly not the first state, abated its capital stock tax for manufacturers starting in the 1880’s. Pennsylvania, not keen to lose firms to New York, followed suit within a year. Cities played the game as well, Louisville Kentucky in 1913, for example, abated all local taxes for manufacturing firms for five years—then had to argue before a state appeals court as to how to define manufacturing (making popcorn at a movie theatre was manufacturing in that case).

Tax abatement, it seems, was woven into our national fabric long before the turn of nineteenth century.

What’s yours is mine: Delegation of Eminent Domain to Private Corporation: Railroads Lead the Way

Railroads were the equivalent of today’s automobile or semiconductor industry in the Early Republic Era.

Railroads were 19th century “platform” sector that disrupted nearly every other sector in some way. Jurisdictional economies and, correspondingly, economic development reacted to railroads in so many ways railroads deserve a mention. For example the impact of Western transcontinental railroads on city formation is a well-worn tale, but railroads built cities in the East as well. These were the years that trunk lines, the backbone of our rail system, were installed by Vanderbilt, Hill, J. Edgar Thompson and John W. Garrett. Eastern cities in every state “bought” railroads to run through their cities. Rochester got three lines to run through its city limits, selling three separate $1 million dollar bonds to close the deals. Buffalo paid $1 million to get an additional line (McKelvey, 1963, pp. 24-5).

Railroad access to Ohio and points west mostly occurred during, and after, the Civil War. “Chicago’s period of vigorous railroad promotion ended in the sixties; St. Louis, after a late start, endeavored in the seventies to recoup lost ground. Toledo and Milwaukee had to take the initiative in building lines as did St. Paul …. “Cincinnati and Louisville competed to extend lines to Chattanooga and Nashville, then to Atlanta and Birmingham—doing their imitation of Sherman’s March to the Sea. Following in their wake were firms seeking expansion into new markets. (McKelvey, 1963, pp. 24-5)

Eminent domain, despite its controversy, became a core tool in the profession; it did so due to its centrality in the development-redevelopment process. Eminent domain is NOT just another tool in the economic developer’s toolbox. Government taking of property for public purposes is one thing. Taking of property from one individual/corporation and transfer of such property to another individual/corporation is doubly a serious matter. On its face government taking away one person’s private property and giving it to another private person is just wrong. The matter is thrice complicated when a private entity is permitted use of eminent domain to achieve its purposes, including simple profit.

Eminent domain, despite the Constitution’s Fifth Amendment forbidding federal/state government from taking private property without “just compensation”, has been, with rare exceptions, a matter of state law. Today there exist fifty-one (including federal government) separate processes with which to conduct eminent domain. Sub-state units of government can add their own provisions and strictures. Each state has constructed its own history, precedents and processes.

Eminent domain has never been restricted to government. Private entities have been delegated these powers by government. Historically, “natural monopolies” (water supply/ distribution, intercity-intra-city transportation, energy and communication networks) have exercised eminent domain subject to regulations and process required by government. They still do so today—although the “naturalness” of natural monopolies is increasingly questioned. Many “natural monopolies” are infrastructure and initial installation and subsequent modernization of such infrastructure are long thought of as “legitimate” in ED. Delegation of eminent domain to private entities has been an important to urban infrastructure as well as urban development/redevelopment. Without eminent domain a road system, canal, railroad, streetcar, water pipe, sewer, electric, cable or telephone wire “can’t get from here to there”.

In the nineteenth century infrastructure-based strategies were much-used ED strategies, and private entities were delegated eminent domain powers. This reality underscores one of our history’s persistent themes: forge a hybrid EDO combining private resources/expertise with public powers/accountability.

When, in this and future chapters, I refer to canals, railroads, “the tangle of pipes and wires”, streetcars, subways, water systems/filtration, electrification, street lights, and even roads and bridges, it implies that we are also including use of eminent domain by a private entity. During the nineteenth century, private entities were delegated public powers, including eminent domain, by state and local government through charters and franchises (our hybrid EDOs). “The private companies built the infrastructure and supplied nondiscriminatory service in exchange for ‘the opportunity to earn a competitive return’” (Saxer, 2005, p. 61). By first decades of the twentieth century this delegation of public powers exploded.

Western state constitutions, as they were initially approved, were especially aggressive in permitting eminent domain for the management and exploitation of natural resources. Water infrastructure and mining (oil and gas, forestry) were critical to Western development, and if they required the taking of private land for the community’s greater good, then so goes it. Transportation infrastructure, the transcontinental railroads in particular, built cities, and railroads required control over the land on which they laid track. Hence the most outrageous aspect of eminent domain in these years was the widespread delegation by state governments of eminent domain authority to a private entities—and it wasn’t only by western states.

Legislatures in many Eastern and Midwestern states delegated eminent domain authority to private transportation and manufacturing companies in order to promote economic expansion in a country with little surplus capital. State courts generally upheld this delegation on the grounds that the needs and wants of the community at that time were served by economic expansion. Thus the companies’ use of eminent domain was for a public rather than a private purpose … from a very early time in the Interior West, private natural resource development took on the mantle of public use…. Courts in those states …recognized virtually no judicial authority to balance the purported needs of the private condemning authority against any countervailing economic, land use, or social concern (Klass, Summer 2008, pp. 21-2)

Federal court preference in eminent domain was to defer to states. When the federal courts conducted constitutional reviews of state actions relevant to eminent domain in private hands, both appeal courts and the Supreme Court give deference to state delegation of eminent domain authority to private actors based on the Court’s acceptance that “different states had different economic needs based on their population, natural resources, and other economic drivers” (Klass, Summer 2008, pp. 22-3).

Nineteenth century tax abatement and delegation of eminent domain to private entities is an excellent introduction, not only to critically important ED tools, but to the predominant ED strategy of the 19th century—it was the Age of Infrastructure. That strategy gained momentum as it became tied to the last of our Chapter One drivers of ED policy: competitive urban hierarchy. To make it all work cities and states experimented to develop an effective and accountable EDO capable of implementing the ED infrastructure strategy.

Footnotes

[i] Wilmington R.R. v. Reid, ,Volume 80 U.S. (13 Wall) 264 (1871)

[iii] The court ruled, for the federal government only. Progressive rate income taxes do not trigger uniformity provisions so long as they apply “generally” throughout the United States. Federal income tax exemptions for manufacturing do not apply to any one firm in one place but to all manufacturing firms.

[iv] Rhode Island Chapter, Associated General Contractors of America, Inc. v. Kreps, 450 F, Sup 338 (D.R.I.)

[v] Williams v. Mayor and City Council, 289 U.S. 36 (1933). The Court ruled uniformity “does not forbid the creation of reasonable exemptions in furtherance of the public good”, supporting local real property tax reductions. The Court held “Furtherance of the public good is written over the face of this statute from beginning to end as its animating motive”; Translation: Good intentions, even if bad law, are sufficient to prove a legislature acts to further the public good.

[vi] Wheeling Steel, Allied Stores v. Bowers 358 U.S. 522 (1959)

[vii] Virgo Corp. v. Paiewonsky 384 F.2nd 569 (3d Cir. 1967), cert denied, 390 U.S. 1041 (1968)

Proceed Onto Theme 2: Module 2 Click Here or Return to Main Menu