South Carolina’s First Venture into Internal Improvements

Navigable rivers were viewed then as we view highways today. They were preferable to roads for commerce, especially bulk because they were more timely and comfortable–probably safer. Navigable and safe rivers, however, do not come naturally; they must be “improved”. South Carolina began this “improvement” in 1793 when it authorized private investors to conduct a venture capital lottery or stock sale) for a canal on the Santee River (which opened in 1800).

A generation later, with the Cotton Empire firmly established in the Upcountry, and fast spreading into Georgia and Alabama (Alabama Fever), the need for additional internal improvement investment rose to the top of the state’s policy agenda. The post-War of 1812 Era of Good Feelings opened the policy window in even the most tightfisted states as South Carolina

The clamor for internal improvements came from several groups. “By 1810. the people of the uplands were concerned in the transit of their cotton to the seaports” [1]. Especially impactful were the people with money. Charleston merchants and politicians were eager to expand their city’s hinterland, and increase profits from cotton export [2]. The need to connect these new hinterlands to the port for export (and import) was obvious. Less obvious was logging/sawmills and the transport of food crops and grains was critical to Lowcountry districts. Road and canal construction potentially benefited all regions, and was seen as the lifeline for rural settlements. The timing had come for internal improvements

South Carolina Attempts “Internal Improvements: Canals and Roads

In the so-called ‘era of good feeling’ large projects of general improvement’ were the order of the day. … After considerable discussion in the press, and among the people and the politicians, in which it appeared that nearly every part of the state wanted some improvement for its traffic, the legislature enacted in December 1818 the following statute [which commences] ‘Whereas, it is expedient to appropriate one million dollars for the Internal Improvements of the State’ [3]

The cry for developmental transportation infrastructure was not exclusively cotton-related. It also included manufacturing and general “people” needs. Moreover highly touted new innovations, the Erie Canal for one, seemed like a bold new direction in solving nettlesome transportation barriers.

It’s hard to believe that so early in our history, a single state or city innovation would launch a thousand copycat initiatives across the nation. Even in 1818 “ED herding” swept across the nation. In South Carolina a “canal fever” created a South Carolina “canal clique”, who seized policy leadership, and off went South Carolina to the innovation races.

In 1822, a landmark State Supreme Court decision cleared the way, literally, for the public role in developmental transportation infrastructure strategy by finding that no private individuals could possess sole right to a waterway suitable for navigation in whole or in part, and it declared such a waterway to be a “public highway” and authorized the state to remove obstructions to make it fit for public use [4]. That finding supported and legitimized an earlier decision to commit the State to road and canal-building.

A major MED strategy requires a suitable EDO to carry it out. In most cities and states, the state-chartered corporation was the vehicle of choice. It had been employed in previous South Carolina infrastructure initiatives. In 1817, however the state legislature, perceiving these entities as “monopolies” from which insiders benefited, preferred to seize control over 1795-approved, zombie state-chartered corporations, restructuring them into a state controlled-chartered canal corporation agency (Erie Canal–a state-run endeavor–was first funded 1816).

The state’s first non-Lowland governor also defended this action by asserting he was breaking up private monopolies, and discontinuing public subsidies–in true Scots-Irish fashion–and inserting the state and its budget to fund a system of roads, clearing navigable waterways, and building canals. Choosing a state-operated public agency to handle the state’s transportation infrastructure deviated from the national paradigm. Why?

Earlier experiences with private-public canal-building state-chartered corporations were considered abject failures. A better part of a decade previous, in 1810, the state legislature had gone on record preferring a state agency over the public-private corporation: “the state chartered corporation was an impotent means of developing state resources“. In 1810, its House committee on Inland Navigation declared that from then on “the State ought never to grant charters to companies for opening … navigation where the funds of the state are adequate to the purpose“.

So in 1818 the same House Committee and General Assembly created a legislatively appointed chief engineer and a legislatively appointed Board of Public Works [5]. Early on, the state demonstrated a reluctance to utilize public-private partnerships, preferring instead to create and use a state bureaucracy. It is likely we are seeing evidence of a Scots-Irish influence affecting transportation infrastructure policy-making.

After hiring a civil engineer, a plan was submitted and approved by the legislature which created a state Board of Internal Improvements to oversee the projects, and appropriated a sum of $1 million (the entire state budget was about $250,000). Numerous roads, and extensive waterway clearing/dams, were included–it was a pork-laden package–but the majority of expenditures funded construction of eight canals of varying lengths and in different geographies. An uproar resulted, but the projects went forward. The initial enthusiasm appeared to dying on the vine as the program was launched.

By 1822, with canals still under construction, way behind schedule and significantly over-budget, the uproar increased–now laced with cries of corruption and incompetence. Steamboats were stranded mid-way and the aura of a screw-up exuded. The legislature launched an investigation which concluded the projects were poorly managed, but could be restructured and an additional $200,000 was appropriated to cover costs. The Board of Internal Improvements was abolished, and the legislature hired a Chief Engineer, set him up as Superintendent of Public Works, and provided him the additional $200,000.

The following uproar alleged that only “great Planters and great Merchants” benefited from canals–the yeoman farmers would use roads. Nevertheless, in 1827, with seven of the eight canals still in construction or in difficulty after their opening, an additional $200,000 dollars were thrown at the construction–generating a new anti-canal movement again alleging the canals “benefit but a small number … while the poor are being taxed for the benefit of the few“. Another legislative appropriation followed in 1828–the last. The Superintendent was fired, and the legislature called an end to the internal improvements program.

A total of $2 million had been spent on these canals–$1.2 million for the Piedmont canals. The first canal (Columbia Canal–a whopping three miles) opened in 1824, to a grand parade; another series opened in 1826, and the remainder officially opened, but were non-functional, in 1829. In the same year the Superintendent reported all canals had serious defects. Twenty-five miles of canals had been constructed over the thirteen years. BTW the 325 mile Erie Canal opened in 1826. By 1840, all were closed, subsequently sold or abandoned [6]

Pay-as-you-go did mean public debt was limited to $1.5 million–and there was never a default. But for all practical purposes South Carolina garnered minimal advantage from the canal-building era. Canals didn’t work out in South Carolina–and South Carolina decision-makers turned instead to railroads. After 1830 South Carolina would now catch “railroad fever”.

Why the debacle?

The usual suspects always include corruption, in the form of those that benefited from the project (i,e, greed) sold it to a trusting misled populace”. Incomprehensible mismanagement usually by government bureaucrats is the next suspect, followed by it was “a crazy idea from the beginning”. Historians settled on politicians using the public demand for internal improvements as a means to fill insatiable needs for patronage and pet projects–and the existence of a “canal cabal”. The debacle was so obvious, so long-standing, and the gap between dissatisfaction and continuation of funding so lengthy, that these suspects should be included in the South Carolina internal improvements bill of laden. But there are more helpful lessons for economic developers.

South Carolina internal improvements were indeed a smorgasbord of pet projects included to benefit settlements along the routes. We saw that in Illinois’s 1837 initiative–and others. Most cleared local small-scale impediments, were probably useful–and quickly, and silently, accomplished. The two core projects were the eight canals and the major toll highway from Charleston to the state capital, Columbia. Both modes-projects ultimately failed. Let’s look at each separately–but before we begin, let’s observe the fundamental underlying problem: each mode was tasked to solve a problem which either because of non-existent technology or excessive costs was doomed to ultimate failure.

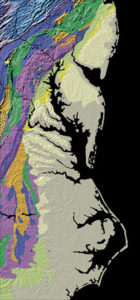

Canals: Canals were constructed to connect Piedmont Upcountry with coastal plains Lowlands–along what was/is known as the Fall Line. The Fall Line is where rivers and topography and technological capacity collide. Not only is there a dramatic change in elevation, but soil and rock as well. In some places, it can be include a “fault line”. Fall line geographies are characterized by non-navigable rough (kayaking) turbulent–and very rapid–waters, a barrier referred to as “droppage”.

Droppage required a series of canals, and locks, the latter accommodating the different levels. Partly the engineering report thought the serious technical issues involved in building canals with the “fast water” were resolvable with existing technology. They caused a number of problems from Virginia on down. Indeed Washington’s favored canal project on the Potomac River got caught up in Fall Line issues.

These issues weren’t satisfactorily resolved in the 19th century. The particular river involved in our South Carolina tale was mastered only in the 20th–by a power company that didn’t care if anybody used the river for transportation. Because there were no plans, measurements or survey’s previous to construction, canal builders experimented as they went along–and experiments went wrong mostly. It wasn’t incompetence necessarily, it is that engineering solutions weren’t up to the task. Overruns in time and budget were inevitable in that context. Make-do solutions didn’t work forever, were too costly to maintain, and canals became both too expensive to use, were constantly broken–and were closed. BTW the Erie Canal involved no major Fall Line.

Toll Highway: Toll highways were commonplace nationally. Private companies, usually state-chartered, were empowered to develop, construct, and operate these highways according to specified standards. The company was responsible for their maintenance, and the legislature set rates for passenger, commercial and exempt use. Debt incurred was off-public budget. Sounds like what we call “privatization” today. South Carolina tried a variation: the state/public did the construction, and “franchised” them off to chartered private companies. Bridges were also built using this model.

The problem in South Carolina’s case was not technology, or speed in construction–they were finished largely on time and budget. They just weren’t used–why? The tolls were too expensive, relative to the benefits obtained by the user. The user mostly continued to use existing “free” trails, paths and “roads” and avoid toll roads–which then didn’t get maintained, and soon deteriorated. The exception to this was bridges. By their nature there were no “free bridges”, and so long as tolls were deemed reasonable, people paid it. Doesn’t that explain New York City’s current “bridge tolls” nexus?

South Carolina Canal and Railroad Company: Charleston’s Equivalent to the Erie Canal

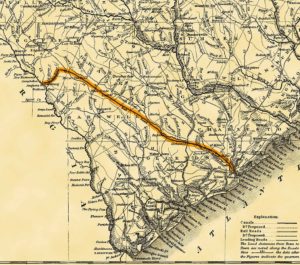

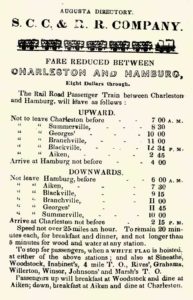

While Pennsylvania’s Mainline and Baltimore’s B&O were slugging it out to cross their states and climb into the Appalachians, South Carolina, led by the Charleston merchant community pioneered the first major American railroad line: the 136 mile long South Carolina Canal &Railroad (SCC&RR). Spanning from Charleston to Hamburg SC (situated across the River from Augusta Georgia), at a cost of $1 million, the SCC&RR was, at its 1833 opening, the world’s longest line under a single management. It was also the first completed railroad line in the United States.–chartered as a private-public state-chartered corporation in 1827–same as Baltimore and Ohio.

Its technology, design, and construction were rudimentary even by then standards. What saved it was that it had to deal with only one 500′ incline–which it handled awkwardly at best. The little engine that “usually” could, huffed and puffed, making the journey which beforehand had taken days on foot/horse, took about twelve hours, if all went well.

So, the commercial age of American railroads started in Charleston (or Hamburg if you prefer). Indeed SCC&RR’s first locomotive, the “Best Friend of Charleston” demonstrated the commitment of that city to pioneer the South’s railroad development infrastructure strategy; it was also the first locomotive built in the United States for commercial rail use–in a West Point New York foundry.

The railroad fever Charleston merchants caught was of English origin. Watching from afar, so was much of Charleston’s merchant-export saturated business community, but their interest was less tied to Charleston’s future promise than the threat of greater expense and falling cotton prices on their margins. Cotton prices in fact had incompletely recovered from the 1819 Panic. Watching their competitors to the North, and feeling the heavy breath of rival Savannah Georgia, they felt they had no choice.

As seen in the past Module Mini-Series on Rise of the Cotton Belt, after 1817 expansion into Georgia, Alabama and Mississippi lowered cotton prices, and diminishing profits in older exhausted fields, put added pressure on reducing logistics costs; Augusta GA captured a good deal of this expansion, and it shipped down the Savannah River to Savannah. Usually tightfisted Carolina planters cried out for “cheaper access to market …[but] the westward progress of the center of cotton production continued remorselessly and Charleston with grief perceived that Savannah, Mobile, and New Orleans were waxing prosperous at her own expense”. Then came the authentic news of the successful operation of railroads in England [7].

Lamenting the lack of access into the interior meant South Carolina cotton producers were “paying a commercial tribute to an outside market“, Charleston businessmen, following a series of “enthusiastic public meetings” (1827-8), jumped on board the proposal of a new venture: the SCC&RR [8].

The Charleston Chamber of Commerce … appointed a committee [which included SCC&RR’s owner William Aiken] to inquire into the probable cost, revenues and advantages of the proposed railroad. Meanwhile the city appropriated five hundred dollars for constructing a model of a railroad in some public place in the city for the edification of the people, and the promotion of the great project. The committee of the Board of Trade reported early in March (1828) in order to prepare the public favorably for the opening of the subscription books [i.e. the public sale of stock by the SCC&RR] which was scheduled. This committee reported in a pamphlet [reports and comments from those] in favor of a railway as against a canal [9]

That there was indeed a railroad fever in the late 1820’s is further supported by Savannah/Augusta GA’s fear of a prospective SCC&RR, prompting their startup campaign to link Augusta to Savannah (and points elsewhere) by rail–eventually resulting in incorporating the Georgia Central RR. The City of Charleston bought $20,000 in stock to kick it off, and stimulate private investment.

Hoping to tap into the potentially deep, if moth-filled, pockets of the state, now headed by an Upcountry governor, Charleston business and political leaders made the trip to the state capital to have the railroad successfully approved as a state-chartered corporation. The legislature dutifully approved (1827) a charter mirrored on those previously issued to canals, bridges, and highways. It granted exclusive right for a specified territory, set rates, and limited profits to 25% of total expenses–and provided a 36-year term.

This seeming success was a major disappointment to SCC&RR owners. Recognizing both the prospects for profits, and even more so knowing the difficulty of raising venture funds for a development transportation mode with no past track record, and a locomotive of dubious practicality–in a hostile investment atmosphere like the Deep South, the owners wanted more state incentives. The profit limitation, for example, had to go; 25% even then was not up to venture capital standards. They argued for a tax abatement, a more liberal (autonomous) governance structure–and state purchase of their stock. They also asked for the right to employ eminent domain on their own authority. The state charter was resubmitted for proper modification.

Justification for this expansive state-chartered corporation, in a state with a already-established record of hostility to state chartered corporations, was the railroad was “worth encouraging … but one [endeavor] that also needed fiscal inducements to spur private investment“. This project was not a “mere private speculation“. This was indeed a “developmental” project necessary for South Carolina’s future economic success–without which decline would surely follow.

Predictably, this all met with considerable resistance from many quarters. Eminent domain was the lightning rod, but the package of changes, so unique to South Carolina, made passage convoluted and untimely. A judicial finding that the Legislature had, and could in this instance, delegate its eminent domain “to other agents“, and so the proposed regulated exercise by the railroad was not precedent-breaking, paved the way. The subsequent new charter therefore defined SCC&RR “an authorized agent of the state, carrying out a great public improvement, not a private corporation seeking private emolument“. The railroad was regarded as equivalent to a public highway, and to South Carolina’s government, and electorate, the SCC&RR was a true public-private partnership and a quasi-public entity [10].

Venture capital raising in Charleston was considerably more difficult than enjoyed by the B&O in Baltimore/Maryland. About $700,000 was the initial goal. The campaign began in 1828, but at its conclusion only half of the authorized stock was subscribed–with all but fifty shares taken exclusively by Charleston investors. Interior southern plantation owners stayed away in droves–even when prodded to invest by local newspapers.

To fill the gap, the Charleston city council authorized the city to purchase two hundred shares–and the city negotiated with the federal government (eventually successful in a backdoor way) to ameliorate the customs/import tariff on English iron rails and machinery, a substantial construction savings. But despite this momentum, private venture investment stalled significantly short of needed sums. So SCC&RR petitioned the state government to purchase of shares directly.

Thinking it had already bent over backward, and not at all predisposed to further direct state investment in this venture, the negotiations went nowhere. Charters were one thing; direct funding quite another.

At this juncture the “Deep South” plantation-owner (the Planter Class) culture asserted itself in the form of a state legislature tilted toward inland-rural planters.

The efforts Charleston’s antebellum mercantile community to develop railroads and effect harbor improvements often conflicted with the interests of planters, particularly when Charleston solicited state support. But the City enjoyed enough political power in South Carolina to ensure critical support for its projects. Commercial interests also prevailed upon the city government to support [such] internal improvements, addling taxpayers with enormous debts for projects designed to revive Charleston’s [declining] commercial vitality [11].

A proposal for a state loan was rejected because the state insisted that railroad assets be used as collateral–a request incompatible with the search for additional venture equity capital.

So. incredibly, SCC&RR “went to Congress” to request Congress purchase $250,000 in stock.

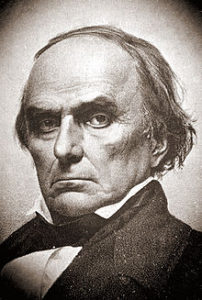

That produced an uproar and political blow-back of the first order. Not from Congress where the matter was dutifully considered, rejected, considered again, rejected, and then killed by Daniel Webster, most hated southern advocate of the even more hated recently-passed “tariff of abominations” for northern industry–the retaliation from which fell on southern cotton exports. Asking Webster for help was the problem–not that he said no. SCC&RR became a pariah, and a “never-SCC&RR” resistance movement commenced.

When it all looked bleakest, events took an unexpected turn. With the SCC&RR literally on the deathbed, Charleston investors were forced to commit themselves to a venture they deemed imperative for personal, professional, and their city’s success.

They pressured the South Carolina House/Senate to get on board, blaming them for SCC&RR’s stupid federal overture–saying the Legislature treated the railroad with a “paper charter and a closed fist“. “When the state government fails to answer the ends of government to the encouragement of domestic industry, it’s time for men to look to their individual rights and interests, and that government is best which best secures them“. They legislature said no yet again. Rejected by the Legislature the business community purchased 6,000 shares in the SCC&RR in 1830. In desperation, SCC&RR was forced to take the state loan.

SCC&RR always was in desperate need of cash, and so while constructing the line in 1832, the RR partnered with local landowner/developer William W. Williams (bet you his middle name was William) to subdivide a 350 acre tract at the ‘500 incline where the line double-tracked and engines were switched. Williams subdivided the tract into 60’x150’ lots, jointly-owned, and proceeded to sell them.

The President of SCC&RR bought 29 himself. Sale price skyrocketed to over $100 when demand exploded. By 1837, the project included 4 hotels, 2 churches, an academy, and bank, public market, with accompanying retail stores and homes for 750 residents. Seeking to cement the partnership, Williams named the new “city”, after SCC&RR’s owner. Today, Aiken SC is home for 31,000[12] .

True to its initial purposes, SCC&RR was a railroad built to serve King Cotton. South Carolina counties shipped to Charleston and not to Augusta-Savannah, and the easy/cheap proximity solidified the profitability of plantations and cash crop farmers–even defying to some degree the Panic of 1837.

Hamburg profited more out of this as the new central cotton hub, and it too expanded greatly. That lasted only until the South’s railroad renaissance in the 1850’s. By the time the War started, Hamburg was a ghost town. Repopulated during/after Reconstruction by a trio of powerful black Freedmen (one, Samuel Lee was Speaker of the SC House of Rep). That new-found resurrection was short-lived. After the brutal Hamburg Massacre of 1876 (which commenced the often violent process of ending South Carolina’s Reconstruction, and installing the solid South Democratic Party), it declined once more, losing its official last resident in 1929.

Footnotes

[1] Ulrich B. Phillips, History of Transportation in the Eastern Cotton Belt to 1860 (2011), pp. 57-9

[2] Lacy Ford, Jr, Origins of Southern Radicalism: South Carolina Upcountry 1800-1860 (1988) p. 15-6

[3] Phillips, History of Transportation in the Eastern Cotton Belt, p. 83.

[4] Tom Downey, Planting a Capitalist South, pp. 54-5.

[5] Tom Downey, Planting a Capitalist South, pp. 102-3.

[6] Daniel Hollis, Costly Delusion: Inland Navigation in the South Carolina Piedmont”, Proceedings of the South Carolina Historical Association (1968), pp. 29-44; also used, Lucy Ford, Jr., Origins of Southern Radicalism, pp. 15-19.

[7] Phillips, History of Transportation in the Eastern Cotton Belt to 1860, p. 17.

[8] Tom Downey, Planting a Capitalist South, pp. 104-5

[9] Phillips, History of Transportation in the Eastern Cotton Belt to 1860, p.138

[10] Tom Downey, Planting a Capitalist South, pp 107-110.

[11] Don H. Doyle, New Men, New Cities, New South (1990), pp. 54-5; A reason for the difficulty in raising funds from Charleston’s business export community (called “factors”) was they hailed from cities like New York and London and other foreign locations. That struggle only got worse in the 1840’s, and Doyle observed that after that time “an indigenous crowd of merchants reclaimed their place in Charleston’s mercantile community” (p.54) Local factors replaced these “foreign” export business leaders in large measure because they left, due to declining fortunes in their businesses. Charleston, certainly by the 1850’s was losing its predominance in cotton export trade, to New Orleans, of course, but to other ports as well (Savannah and Mobile). An important reason for this decline was the unwillingness of Deep South South Carolina to finance internal improvements to access its hinterland more cheaply and effectively. Over the next forty years, Charleston’s business community became inbred, set in its ways, having learned to live with its limited position in a setting-sun export economy (pp. 111-13)

[12] Tom Downey, Planting a Capitalist South, Table 4, pp. 98-100.